Feature Spotlight – Effortless invoicing: An intro to automating accounts receivable emails

Marketing Team

k-ecommerce

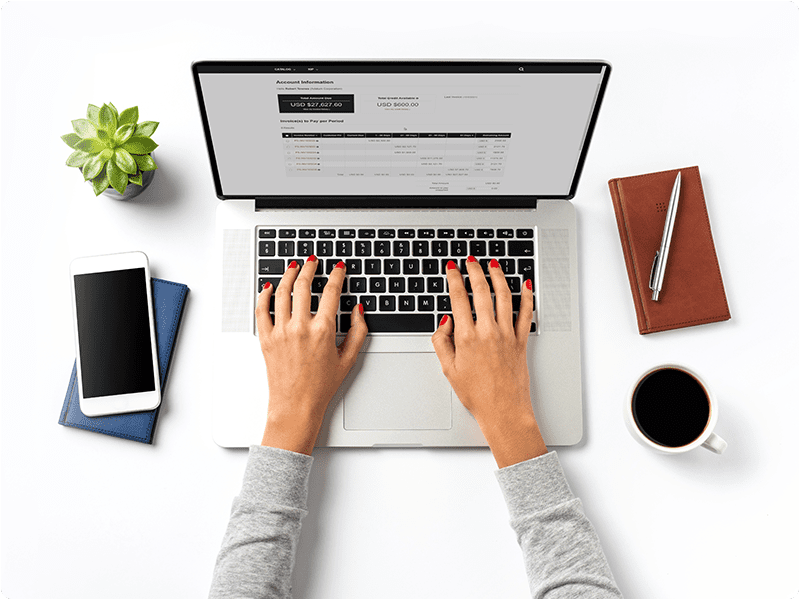

As your business grows, invoicing comes with many challenges — maintaining accurate data, processing the invoices, and ensuring they get paid on time, to name a few. It’s common for complications and setbacks to result in revenue delays, as you can likely attest to. Solve this by automating your invoicing processes with accounts receivable software.

In this guide, you’ll discover the causes of accounts receivable pain points and how our ERP-integrated payment solution, KIP, solves your collection management. Learn how three of KIP’s standout features automate invoice emails to make your accounting process seamless. You’ll discover a trusted payment solution for accounts receivable that helps foolproof the invoicing process.

Email Automation & Pay Multiple Invoices Paired with Pay Now: Key Features of Our KIP Solution

The Pay Now feature allows you to create secure payment links, while Email Automation will set up automated accounts receivable emails for your invoices. With a few clicks, Pay Multiple Invoices directly in your ERP or send Multiple Pay Now links to several of your customers at your convenience.

It’s easy: Just add customer profiles to your ERP, group them according to their payment processes, types, and methods. Even better, we’ve created email templates for various invoicing scenarios. Use them directly or change them to align with your company’s style.

It’s easy: Just add customer profiles to your ERP, group them according to their payment processes, types, and methods. Even better, we’ve created email templates for various invoicing scenarios. Use them directly or change them to align with your company’s style.

With Pay Now, you can auto-generate secure payment links and send them to your customers with Email Automation. Using the Multiple Payments feature, you can send Pay Now emails in just a few clicks and at your convenience. Each email contains a personalized and secure payment link generated by the Pay Now feature.

Our Email Automation feature allows you to schedule the emails so all your customers receive invoices on time — and periodically, if needed. You can move past manually, paying each invoice and sending off emails one by one.

Customers will open the email and simply click the secure link to complete their payments, simplifying the collection process.

Our KIP solution is designed specifically to solve the major accounts receivable challenges every business faces. First, understand those challenges, so you’re in the best spot to capitalize on the KIP solution.

Accounts Receivable Pain Points

- Manual invoicing errors

- Delayed payments

- Administrative challenges

- High costs

Typically, B2B accounts receivable departments face several challenges when processing invoices. Here’s how the KIP trilogy of features can help them:

Manual Invoicing Errors

There’s a higher chance of error when people manually enter data on invoices. The process is also time-consuming, which can especially hinder large organizations with hundreds of invoices to process.

Using the KIP features reduces the chance of errors because it’s automated. It also accelerates the payment processing workflow, since you can generate multiple links simultaneously and schedule them in advance.

Delayed Payments

In Q3 of 2023, there were 18 industries where companies commonly had 10% or more of their accounts receivables delayed over 90 days. Delayed customer payments were especially a concern in the manufacturing, equipment, repair, furnishing, and social services sectors. Overall, almost no business is immune to late payments.

In Q3 of 2023, there were 18 industries where companies commonly had 10% or more of their accounts receivables delayed over 90 days. Delayed customer payments were especially a concern in the manufacturing, equipment, repair, furnishing, and social services sectors. Overall, almost no business is immune to late payments.

Email Automation helps mitigate this issue by enabling automated follow-ups over multiple time intervals. Even when a customer forgets to pay, and you haven’t noticed, the automated system will follow up in a week, a month, or whatever interval you configure.

Administrative Challenges

Managing B2B accounts receivable processes can be difficult, especially if your customer base is split between payment types and method. While some clients pay with credit cards, others might prefer debit cards (ACH or EFT) Their invoicing and payment processing requirements are different. Pay Now supports credit card payments, but our Multiple Invoice Payment feature goes further by allowing you to configure ACH and EFT payments. Plus, its batch processing ability for recurring invoices makes it a standout solution.

With Pay Now, you can generate secure payment links for each invoice and send them to the respective customer groups. Accounts receivable management becomes easier since you aren’t manually accommodating each customer’s requirements.

High Costs

Manual processes result in higher costs for the business. Contributing factors include the wages for hours of administrative work and the unforeseen expenses due to errors in invoicing.

In contrast, using accounts receivable automation software cuts down these expenses by providing greater efficiency and accuracy in invoice processing. That’s why many businesses are adopting AR automation software and its projected market value is $5.32 billion by 2029.

Benefits of Using KIP for Accounts Receivable Emails

By streamlining invoicing, accelerating payment processing, and reducing manual tasks, Email Automation & Pay Multiple Invoices paired with the Pay Now feature solves the typical accounts receivable pain points. To replicate these results for your business, focus on the following features.

By streamlining invoicing, accelerating payment processing, and reducing manual tasks, Email Automation & Pay Multiple Invoices paired with the Pay Now feature solves the typical accounts receivable pain points. To replicate these results for your business, focus on the following features.

Seamless Integration With Existing ERPs

The KIP solution seamlessly integrates with prominent ERP systems, namely Microsoft Dynamics 365 Business Central and Microsoft Dynamics GP.

KIP can directly access data in your ERP to send invoices. It syncs data in real time, which streamlines AR processes.

Learn more about how you can leverage these integrations by watching our KIP solution demo.

Multiple Payment Link Generation

Unlike other automated AR solutions, the Pay Multiple Invoices feature paired with Pay Now can send multiple payment links at once. This expedites payment collection because:

- Customers can directly pay through this link with no hassle, which helps reduce late payments and improves your customer experience.

- There’s a lower chance of typos; the payment links automatically retrieve and fill in previously saved information. You avoid errors that cause delays and complaints.

- Online payment links save your finance team time and effort. Instead of customers receiving invoices after your team spends time on data input and drafting, customers will receive their bills automatically on time.

Another feature you’ll appreciate is the ability to customize email templates based on your brand and preference.

Easy Follow-up Automation

To uphold due diligence with late payments, use Email Automation to schedule payment reminders for 30, 60, or 90 days in advance. You can also set up a custom reminder schedule for any number of days after the invoice is overdue.

Considering many B2B payments come late, a quick follow-up — with a hassle-free payment link — is an effortless way to receive your money earlier.

Accurate Payment Records

KIP helps you keep accurate records of invoice payments. Through links, confirmations, and receipts, it’s visible on both your business’s end and the customer’s end. We provide reports to help you manage exceptions when paying multiple invoices.

KIP helps you keep accurate records of invoice payments. Through links, confirmations, and receipts, it’s visible on both your business’s end and the customer’s end. We provide reports to help you manage exceptions when paying multiple invoices.

With Pay Now, customers don’t need to type out their details every time they pay; only the link they receive changes. Their browser remembers the payment details from previous invoices.

With automated details filled in on both sides, there’s much less chance for typos. Plus, it’s easier to keep track of electronic invoicing records you’ll use for financial reporting. This reduces the risk of data breaches and online payment fraud.

Final Thoughts: Solve Collection Management with KIP

Creating and sending multiple invoices every month comes with its own set of challenges.

With functionality like scheduled emails and automated data entry, Email Automation paired with Pay Now is a seamless payment solution for accounts receivable.

Your invoicing processes will be quick, secure, and cost-effective without the hassle of manually accommodating payment methods and delays due to typos.

With accounts receivable automation, KIP becomes an end-to-end payment solution that helps you handle everything from sending invoices to improving customer service. KIP offers a dynamic trilogy of features specifically designed for your Microsoft Dynamics 365 Business Central and Microsoft Dynamics GP payment needs. To learn more, check out KIP, our payment portal designed for B2B businesses.