See how B2B trends and buyer needs shape your future in our new eBook.

Create an efficient and secure way to do business

Shorten the sales cycle and benefit from better margins

Personalize your clients shopping experience

Create an efficient and secure way to do business

Shorten the sales cycle and benefit from better margins

Personalize your clients shopping experience

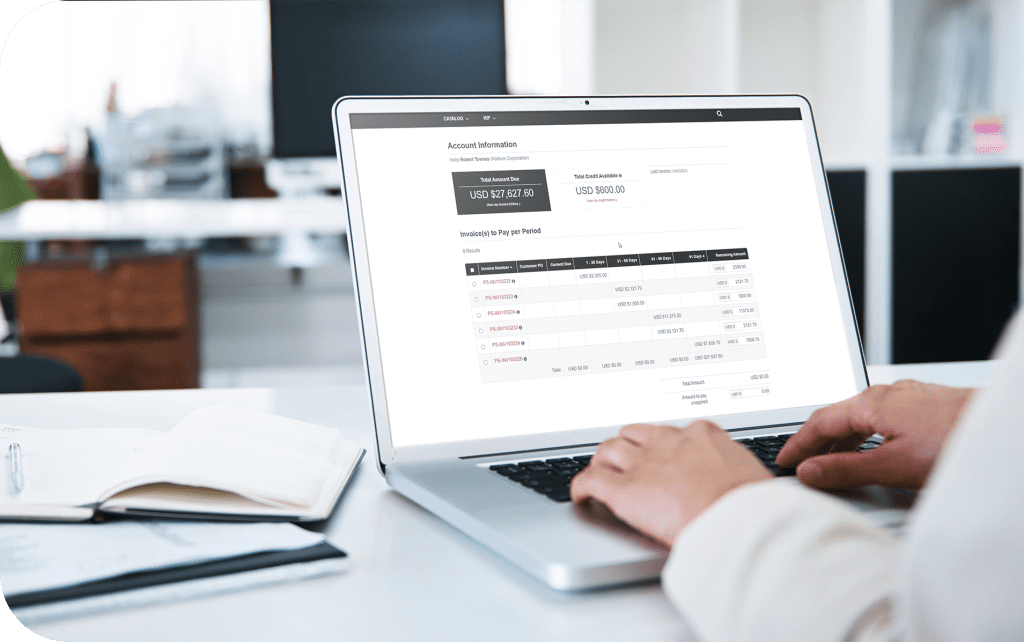

Explore the value of simplified payment management in B2B.

Maintaining a healthy cash flow is crucial to any scaling business.

But many of the essential functions of the accounts receivable process (like remittance or map checks) are outdated or highly manual, which means they also bog down your teams and eat up their time.

Nonetheless, Accounts Receivable (A/R) management is a crucial aspect of maintaining a steady flow of cash, minimizing bad debt, and operating a successful omnichannel business. Which means finding ways to do it efficiently and effectively is essential to success that will last.

Larger orders, deeper customer relationships, and various terms of payment make digital excellence difficult to achieve for B2B businesses.

For teams that are looking to improve their payment processing, it’s important to look out for solutions with all the right capabilities to seamlessly address the most pervasive issues B2B businesses —especially small and mid-sized organizations— face with payment management and A/R.

To face B2B payment processing’s top hurdles, you’ll need a way to:

In a world where three-quarters of SMBs in B2B experience the negative impacts of payment delays, businesses are overdue for a more productive, hassle-free way to manage their finances.

By knowing the top A/R-related challenges to look out for, you can better prepare to embrace a seamless, efficient, and highly automated way of managing payments.

Importantly, it also means you get paid sooner and more easily.

of B2B small and mid-sized businesses are negatively impacted by late invoices, with 3 in every 4 businesses experiencing delays in receiving payments.

Most often, B2B finance teams are challenged by:

Some businesses don’t have a unified solution for all their operational activities, instead using different systems for each part of their operations. They use one system for sales, another for ERP, and another for accounting. These legacy systems exist in silos and aren’t interconnected. And while things may operate at a reasonable efficiency level for day-to-day business operations, the problems usually start when it’s time for reporting.

Retrieving and organizing accounts receivable information from each system can be tedious, time-consuming, and prone to errors. This process becomes more complicated when mistakes happen. Organizations waste time resolving discrepancies due to data entry errors or incompatible data types.

Without policies and procedures to guide your A/R team, problems continue to grow and affect your cash flow. Think: lacking documentation for basic processes. Team members might end up following their own rules for routine tasks like documenting invoices, resolving disputes, or collecting payments. Plus, even when a policy exists, if team members don’t understand and follow it, it’s the same as not having one.

Companies that continue to rely on manual A/R management increase the risk of human errors affecting their efficiency.

A/R automation allows for the standardization of data and processes across company departments, which in turn reduces the occurrence of conflicting data and increases collaboration between teams. This means you can reconcile accounts, generate reports, and produce actionable data for decision-makers in a fraction of the time, without any risk of order-to-cash cycle issues.

With B2B ecommerce automation, you won’t have to spend a considerable amount of time completing manual tasks or procedures. And in many ways, it’s the most vital key to solving major A/R challenges.

With the right technology to help automate and ease the burden on your team, you can take once manual processes and stop worrying about them for good. That includes automating overdue invoice reminders, calculation of late fees, and scheduled reporting.

To make sure your automation works without a hitch, be sure to also:

Harmonize your systems and make it easier for them to talk to each other. Upgrade from siloed systems that don’t communicate with each other to integrated systems that share data and simplify the collections process.

Create and/or update your policy for the A/R process to properly document all its steps. Your days sales outstanding (DSO), collection effectiveness index (CEI), and accounts receivable turnover ratio are some key metrics your policy should cover. Your documentation should also include payment terms, billing processes, a credit policy, and a collections strategy.

Enable electronic payment methods —like k-ecommerce Integrated Payment (KIP)— via a portal to enable your customers to self serve, pay their invoices and manage their accounts online.

“While research from Gartner suggests that 80% of B2B payment will be digital by 2025, there remain issues with existing digital processes.

The most common problems with current B2B payment options [today include] lengthy payment process times, limited visibility into the payment journey, and supporting real-time payments in B2B.”

The best way to automate A/R tasks and help your ecommerce corporate finances function more smoothly? By integrating your payment solution to your ERP to benefit from:

Simplified bank reconciliation

Automated reconciliation lets you process payments from all sales channels with fewer risks of error. It can help find discrepancies quickly, reducing the chances of fraud and damage to your business. And according to Zapier, it can help you see a 33% decrease in errors and time saved by automation.

With KIP, you can see your cash flow at a glance, and continuously monitor outgoing invoices and incoming payments.

Comprehensive tracking

Integrating your ERP and payment solution helps synchronization and data sharing between the two platforms (like for purchase orders, invoice details, and credit limits). This makes it possible for online businesses to receive cash and optimize A/R in just a few hours.

What does this look like in practice? It means that since payment information is instantly updated in the ERP ecosystem, the accounting department doesn’t need to manually update credit card payments during accounts reconciliation.

KIP empowers you to create transactions on sales orders and posted invoices with a few simple clicks. Transaction amounts and their journal entries are automatically taken care of, making payment processing convenient and secure for all parties involved.

With KIP, sales documents and their transactions can truly operate hand-in-hand without the worry of accounting making mistakes, or even leaving the ERP.

More transactional power

KIP provides complete omnichannel digital payment solutions integrated into Microsoft Dynamics 365 Business Central and Microsoft Dynamics GP. It’s built to help scaling B2B ecommerce businesses with:

The platform supports all major debit and credit cards and bank transfers, and enables the processing of all transactions from your ERP’s sales document screen. The result? You can maximize productivity by creating credit card or bank transactions on sales documents directly from your ERP.

All the convenient payment methods customers demand are driving B2B sales worldwide. But with this surge comes risk, as credit cards and digital payment applications can become victims of cybersecurity attacks.

Because of this, the Payment Card Industry Data Security Standard (PCI DSS) was developed as the primary standard for safeguarding credit card transactions and similar payment solutions.

Why is PCI Compliance important?

PCI DSS compliance reduces the risk of attacks and increases compatibility with major card payment solutions. All major credit card companies are members of the PCI SSC and embrace the global standards, and continued non-compliance can lead to a terminated contract with any of the PCI SSC card brands.

How do businesses become PCI compliant?

While PCI compliance is important, note that it’s a time-consuming and expensive process. You must follow these four major steps:

It’s also important to be aware that there are four different PCI compliance levels:

To become PCI DSS certified, a business needs to follow the assessment steps based on its level and submit to audits from Qualified Security Assessors (QSAs) to verify compliance. That can be difficult to implement for a small business, not to mention costly.

To reduce the cost and complexity, most will select a payment processor like k-ecommerce: with certified solutions that keep the business within PCI Level 1 compliance and ensure that, as an online merchant, you don’t store credit card information in your system — ever.

Finance teams looking for better payment management tools should leverage solutions that can provide immediate actionable results and cost efficiency — without the need for downtime for set up. Choosing the right solution enables teams to streamline their payment processing and manage their cash flow effectively. This frees them up to focus on growing the business, all with zero disruption.

Whether you choose KIP or another option as your B2B payment solution, you should look for one that offers all the right tools, flexibility, and capabilities to simplify the payment complexity that has historically challenged accounting teams.

Look out for:

The real-time communication between your payment solution and your ERP ensures speed and accuracy on every transaction with amounts and their journal entries all automatically taken care of.

Empower your customers with the freedom to pay their bills online 24/7 using the payment portal, without any support needed from your end.

Supporting a variety of payment methods enables you to accept all major credit cards, ACH/EFT, credit memos, even general payment unassociated to an invoice.

A reliable solution has all transactions processed in a PCI Certified private cloud environment (ideally Level 1!) and uses AVS/CV2 validation to ensure the security of customers’ cardholder data.

Comprehensive reports offer data at your fingertips, including access to electronic transaction reports.

Time is money. And to manage your cash flow and stay in business, you need accurate real-time data, seamless data transfers, and quick cash conversions. With KIP, you get an ERP-integrated payment solution that helps you automate A/R tasks, minimize human error, and guarantee secure payments — 100% of the time. Think: less time spent chasing invoices and more freedom to reinvest in your business for growth.

Choosing KIP as your payment solution means benefitting from:

"The implementation of KIP allowed our accounting team to continue operating at the same capacity [with fewer resources]. We have had significant growth in sales and transaction volume, without the need to add staff."

Matthew Cook

Controller